Building Fortuna: A Better Way to Plan for Financial Goals

Why am I investing?

I couldn’t answer this when I started in 2019. Neither could anyone I asked. They’d say “to get good returns” or “to grow my money.” Vague ambitions, not goals. Investing without a goal is like sailing without a destination. You’re moving, but you don’t know if you’re on the right course, how much risk to take, or when you’ll arrive. The pattern is everywhere. Someone opens a mutual fund account, starts a SIP because everyone says they should, and then… nothing. They check their portfolio occasionally, feel good when it’s up, anxious when it’s down. But they have no idea if they’re making progress toward anything meaningful.

This bothered me. When I built Fortuna’s goal planner, I wanted to anchor everything to concrete outcomes. A house down payment in five years. College education in fifteen. Comfortable retirement in thirty. Once you have a goal, every decision becomes clearer. Your time horizon defines your risk tolerance. The goal’s future cost determines your target corpus. The date you need the money tells you how aggressive or conservative to be.

The Problem with Most Financial Planning

Most financial advice boils down to a simple, misleading formula: “Invest X amount, get Y% returns, and you’ll be rich.” This is comforting but wrong. The market doesn’t move in straight lines. A plan that ignores this reality is doomed to fail. Why? Because that 12% average return isn’t what I’ll actually experience. In year one, I might get 18% returns. Great! In year two, the market crashes and I’m down 8%. Year three gives me 22%. Year four is flat at 3%. Over the long run, this might average out to 12%, but the path matters enormously. The final outcome depends on the sequence. The choices I make when the market is up 20% and when it’s down 14% drive the outcome.

This is called sequence-of-returns risk. Here’s what it means: if I get good returns early and bad returns late, I end up with more money than if I get bad returns early and good returns late, even though the average is the same. Traditional calculators ignore this completely.

When I started building the goal-planning engine, I wanted to embrace reality. The philosophy I landed on is built on accepting uncertainty and using probabilities to navigate it. I’ve written about this philosophy in detail for retirement planning, but the same principles apply to every financial goal.

Three Principles I Built Around

1. I Can’t Predict the Future, So I Plan for All of Them

Instead of pretending I could guess the market, I decided to use Monte Carlo simulations. The name sounds fancy, but the idea is simple. I run thousands of simulations of my investment journey, each with different market returns based on what has actually happened historically. For each goal, I run 2,000 different scenarios. Some scenarios hit a bull market early. Some hit a crash in year five. Some see steady, boring growth. I get to see all the possible paths my investment could take.

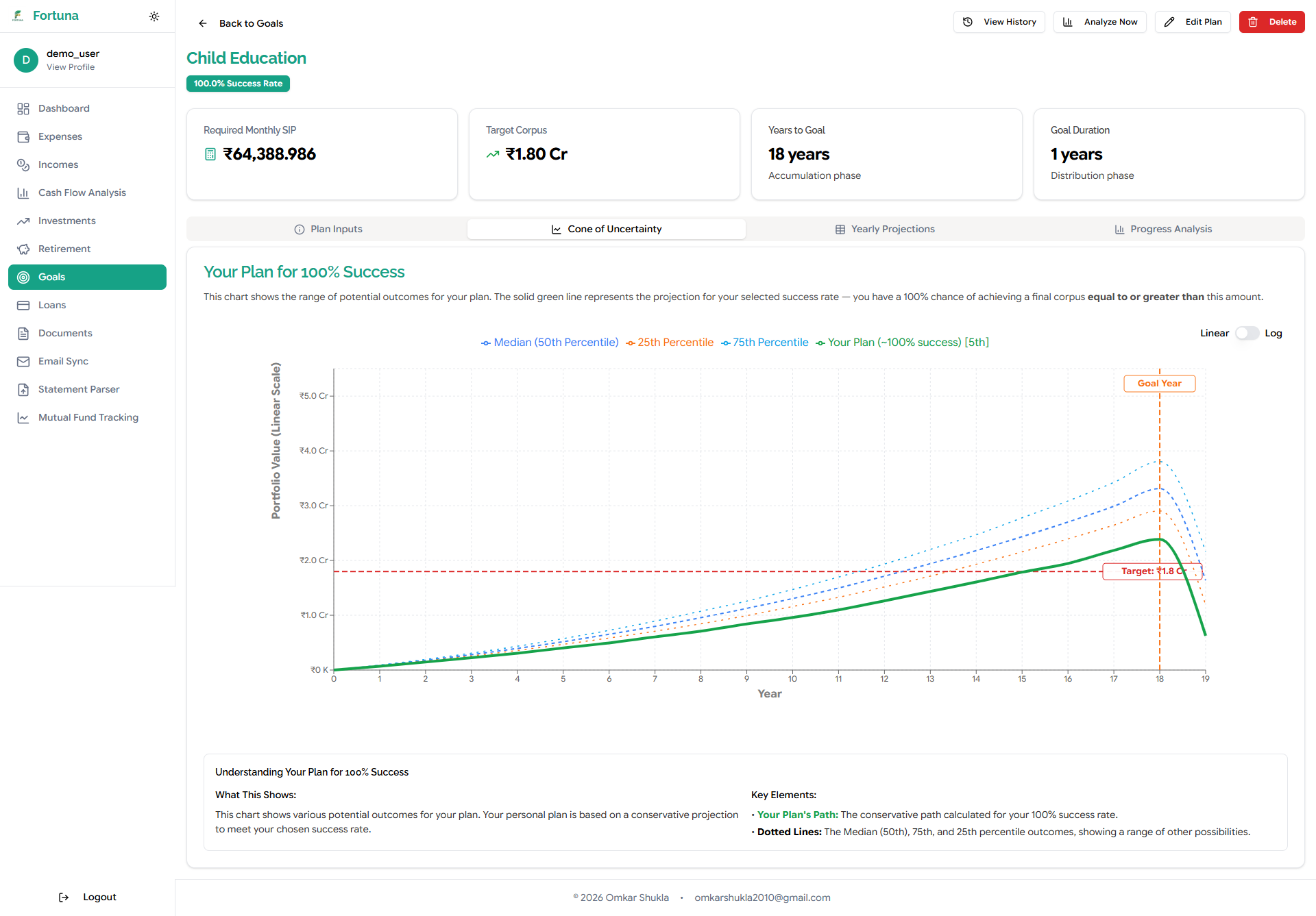

This doesn’t give me one number. It gives me a “cone of uncertainty,” a range of possible outcomes.

The cone shows me the full range of what might happen. The middle line is the median outcome. The outer edges show the best and worst case scenarios. And most importantly, the system can tell me: “With a monthly SIP of ₹25,000, I have an 85% chance of reaching my ₹1 crore target in 15 years.” Why is this better? Because it lets me answer a more honest question. Instead of asking, “How much will I have?”, I ask, “What monthly investment gives me an 85% chance of reaching my goal?” It’s about making decisions based on probabilities.

I can adjust that probability based on how important the goal is. For a child’s education, I might want 90% certainty. For a vacation fund, 70% might be fine. The system calculates the required SIP for whatever confidence level I choose.

2. The Glidepath: Automatically De-Risking as I Get Closer

Here’s a question most investors don’t think about: should my investment strategy when I’m 20 years away from a goal be the same as when I’m one year away? Obviously not. But most people invest the same way throughout their entire journey. They pick a balanced fund or a portfolio mix and just leave it. This is a mistake. A long-term plan needs to balance growth and safety, and that balance should shift over time. When my goal is decades away, I can afford to be aggressive. If the market crashes tomorrow and my portfolio drops 30%, who cares? I have 20 years for it to recover. In fact, a crash is good because my monthly SIPs are buying at cheaper prices. But as I get closer to needing the money, a market crash can be devastating. Imagine someone who has been investing for 14 years toward their child’s college education. They’ve built up ₹90 lakhs. Just one more year to go. Then the market crashes 30%. Suddenly they have ₹63 lakhs. Their child’s college admission is next year. They don’t have time to wait for recovery. They’re screwed.

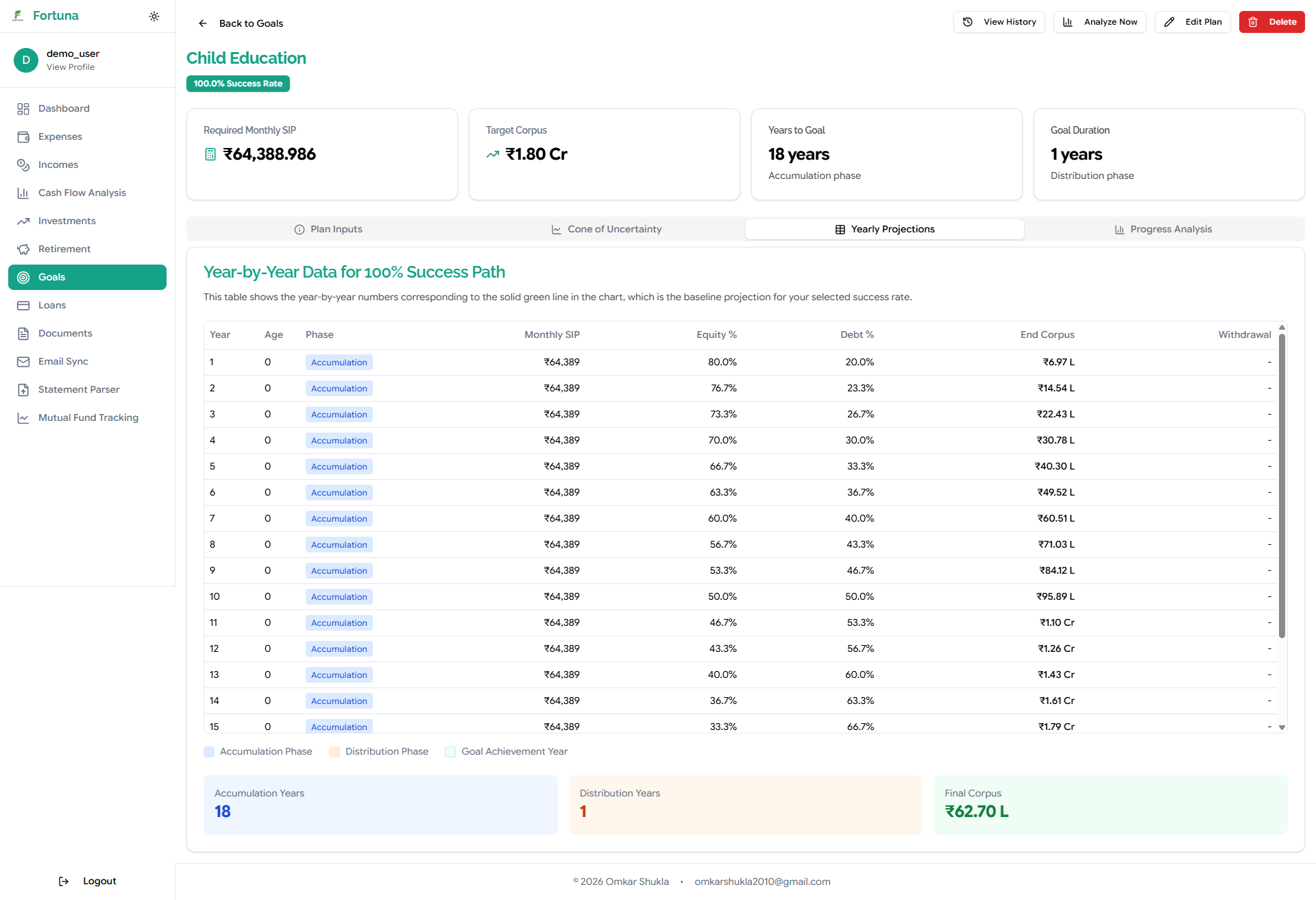

This is why asset allocation needs to change over time. I built an automatic glidepath into the system. When I start, my portfolio might be 80% in equity. Equity is volatile, but over long periods, it gives the best returns. As my goal’s target date approaches, the system gradually and automatically shifts my allocation toward safer assets like debt. By the time I’m three years away from my goal, I’m at 30% equity and 70% debt. This helps lock in my gains and protects my savings when I need them most. I’ve essentially won the game. The last thing I want to do is take unnecessary risks and lose it all at the finish line. The glidepath isn’t just a one-time adjustment. It’s a smooth, gradual transition that happens every year. The system calculates the optimal equity-debt mix for each year of my journey and shows me exactly what my portfolio should look like at each stage.

3. A Plan That Learns: The Feedback Loop

Financial plans should not be static. They need to be reviewed and adjusted regularly. It’s a living roadmap. Life changes. Markets change. My income changes. My goals might change. A plan that doesn’t adapt to reality is useless. I built a progress tracking service as a continuous feedback loop. I can link my actual investments to each goal. The system tracks their current value and compares it to where I should be based on my original plan.

Every time I check in, the system tells me three things:

First, am I on track? It compares my current portfolio value to the expected value from my plan projections. If I’m within the expected range, I’m on track. If I’ve fallen behind, I’m at risk or behind.

Second, what’s my projected outcome? Even if I’m on track today, the system runs a fresh simulation based on my current position. It projects forward to show me where I’ll likely end up if I continue with my current strategy. This tells me if I’m still on course to hit my goal.

Third, what should I do? This is the most important part. If I’m behind, the system doesn’t just tell me there’s a problem. It calculates the exact lumpsum or extra monthly SIP I need to get back on track. If my asset allocation has drifted too far from the glidepath, it tells me exactly how much to move from equity to debt or vice versa.

How I Built It to Work

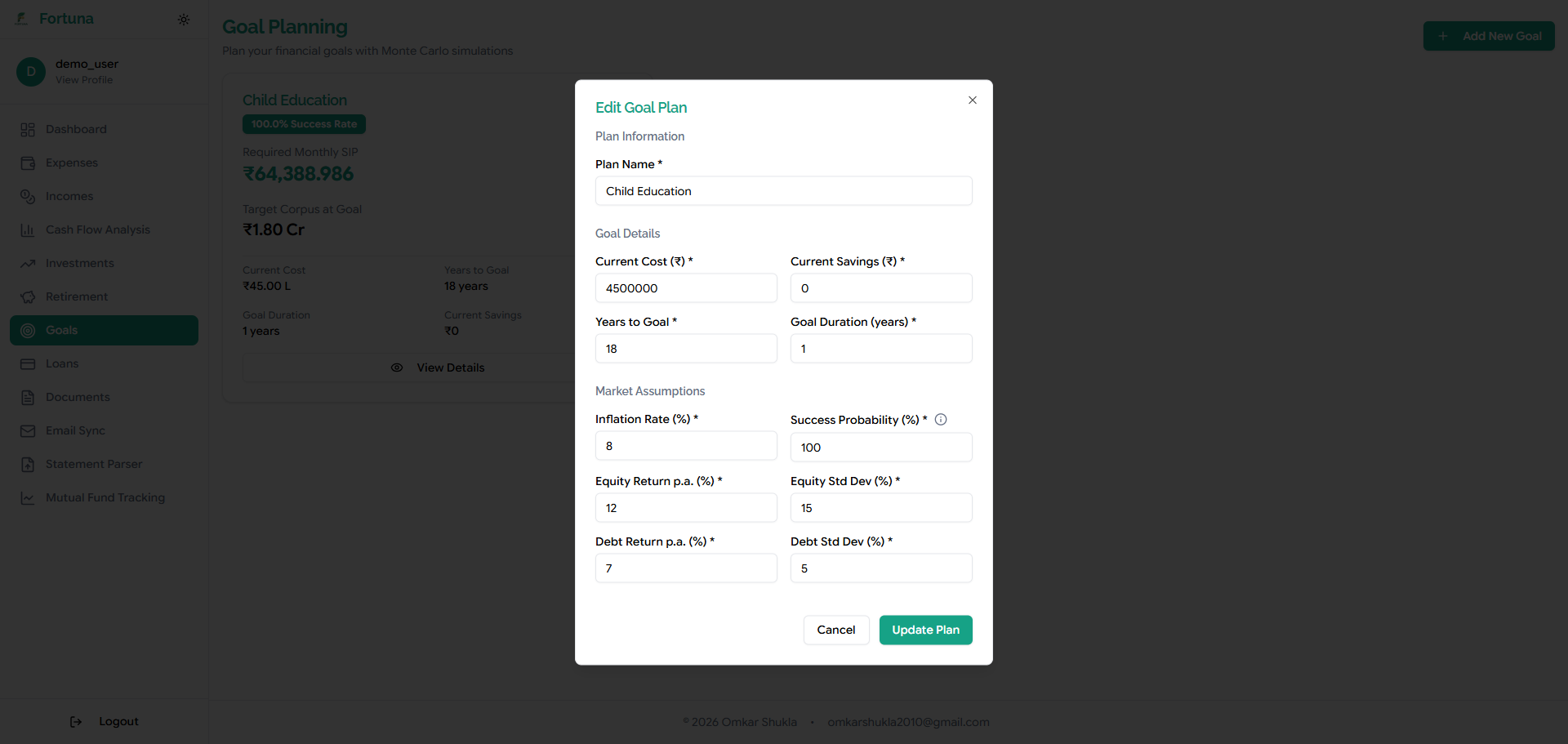

The goal planner I built is for specific targets like a down payment, a child’s education, or a dream vacation. I start by describing my goal. What does it cost today? When do I need the money? How long will I need to draw from the corpus? (For example, college education might need withdrawals over multiple years.) Do I already have some money saved toward this goal? Then I provide my assumptions. What inflation rate should I use? (Education inflation is typically higher than general inflation, for example.) What returns do I expect from equity and debt? How confident do I want to be in hitting this goal? The engine then runs the simulation to find the precise monthly SIP required to hit that target with my desired level of confidence.

But I don’t just get a single number. The system stores the year-by-year projections, the recommended asset allocation for each year, and the data needed to show me the full cone of uncertainty. I can see exactly how my portfolio should evolve over time, what returns I’m assuming, and what could go wrong.

I can map my actual investments to this goal. Got three mutual funds I’m investing in for my child’s education? Link them to this goal. The system will track their total value and show me if I’m on track.

![]()

Why Retirement Is Different

People often ask: isn’t retirement just another goal? Can’t I use the same planner?

Not really. Retirement planning needs special treatment because I’m not just saving for a number. I’m building a system that has to last decades while I’m withdrawing from it. The challenges are different. I need to think about withdrawal strategies, how to protect against running out of money, and how to handle market crashes when I can’t just wait them out. If someone retires and the market crashes in year one, they might be withdrawing from a depleted portfolio for years. This can devastate their long-term sustainability.

I wrote a separate post about how I approach retirement planning in Fortuna. It covers the 4-bucket strategy I built for managing withdrawals and why sequence-of-returns risk matters more than most people think. The philosophy is the same as goal planning: embrace uncertainty, plan probabilistically, and give me concrete numbers instead of vague advice. But the implementation is specialized for the unique challenges of retirement.

The Hardest Part

The hardest part of goal-based investing isn’t the math or the planning. It’s getting clear on what I actually want. Most people have vague notions of “saving for the future” but no concrete goals. This method forces me to sit down and ask: what do I actually want money for? When do I need it? How much will it cost? Being specific helps. Not “save for retirement someday” but “retire at 55 with ₹8 lakhs per year in expenses.” Not “save for my child’s education” but “fund four years of engineering college starting in 2035, which will cost about ₹40 lakhs in today’s money.”

Once I have this clarity, the rest is just simple math. Good and honest math, but still just math. The planning engine can figure out what I need to save, how to invest it, and whether I’m on track. By combining probability-based planning with automatic asset allocation and continuous progress tracking, I built an engine that is honest, robust, and useful. No comforting lies about guaranteed returns. Just a realistic range of outcomes that helps me make decisions that maximize my chances of success.